Market Overview:

The non-ferrous metals market is experiencing rapid growth, driven by accelerated urbanization and infrastructure development, clean energy transition and e-mobility push, and advancements in recycling and circular economy policies. According to IMARC Group's latest research publication, "Non-Ferrous Metals Market Report by Type (Aluminum, Copper, Lead, Tin, Nickel, Titanium, Zinc, and Others), Application (Automobile Industry, Electronic Power Industry, Construction Industry, and Others), and Region 2025-2033”, the global non-ferrous metals market size reached USD 1,183.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1,746.9 Billion by 2033, exhibiting a growth rate (CAGR) of 4.2% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Claim Your Free "Non-Ferrous Metals Market" Analysis Sample Report Here

Our report includes:

- Market Dynamics

- Market Trends And Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Non-Ferrous Metals Market

- Accelerated Urbanization and Infrastructure Development

Urbanization is fueling a massive upswing in demand for non-ferrous metals like aluminum, copper, and zinc. As more cities spring up and existing ones expand, the need for reliable power grids, modern transportation, and smart buildings surges. Aluminum and copper are vital for wiring, piping, window frames, and countless components in rising urban landscapes. In some regional markets, infrastructure sectors already account for a notable portion of total non-ferrous metal use, with countries like India reporting a market value above $38 billion, heavily supported by government-led smart city and public transport initiatives. National campaigns such as 'Make in India' further amplify growth by prioritizing domestic manufacturing and requiring massive amounts of non-ferrous materials to build up new factories, bridges, and metro systems.

- Clean Energy Transition and E-Mobility Push

The global pivot towards greener energy sources is driving a remarkable spike in the use of non-ferrous metals. Solar panels, wind turbines, and batteries for electric vehicles (EVs) are heavily reliant on elements such as lithium, cobalt, copper, and aluminum. For instance, copper is unmatched in conducting electricity efficiently, making it indispensable for EV wiring, charging stations, and renewable energy installations. The expanding renewable energy landscape—which now features annual additions of over 500GW worldwide—directly translates to greater demand for these metals. In response, governments are rolling out incentive schemes for mineral recycling, while major manufacturers team up for domestic sourcing and innovations in battery material processing, solidifying the non-ferrous metals industry as a backbone of the new energy economy.

- Advancements in Recycling and Circular Economy Policies

The recycling revolution is reshaping how industries source non-ferrous metals. With many governments enforcing recycled-content mandates—India requires all new non-ferrous metal products to contain at least 5% recycled material, rising to 10% for copper and 25% for zinc—there’s a clear market shift. Globally, the recycling sector for non-ferrous metals is valued at over $90 billion, emphasizing both economic and environmental importance. These efforts cut production costs, lower emissions, and boost supply chain resilience, especially as nations seek to reduce reliance on imported raw materials. Policy roadmaps and incentive programs push both innovators and established players to double down on advanced extraction and recycling technologies, ensuring metal supply in a resource-tight future.

Key Trends in the Non-Ferrous Metals Market

- Rise of Lightweight Solutions in Automotive and Aerospace

Automakers and plane manufacturers are all-in on lightweighting: reducing vehicle and aircraft weight to meet fuel efficiency standards and cut emissions. Aluminum, titanium, and magnesium have become the go-to alternatives. For example, aluminum is now the standard in manufacturing car body panels and aircraft frames, as it slashes overall weight without sacrificing strength. The drive for lighter vehicles has led to non-ferrous metals comprising a bigger share of parts, such as electric vehicle batteries and structural components. Notably, over 88% of global EV sales are concentrated in just a few leading markets, powered by this shift to lighter, energy-efficient materials—proving how pivotal non-ferrous innovation is across mobility sectors.

- Digitization and Smart Manufacturing

Digital transformation is upending the non-ferrous metals industry. From advanced surface coatings to AI-driven process optimization, manufacturers now harness digital tools to boost efficiency and product quality. For instance, companies leverage sophisticated sensors and real-time analytics to minimize waste in aluminum smelting or optimize copper refining—resulting in higher yields and lower operational costs. Smart factories and data-driven logistics also speed up delivery to end industries like construction and electronics. Collaborative R&D between tech firms and material producers is accelerating the adoption of digital quality controls and traceability, ensuring compliant and sustainable production lines that resonate with today’s demanding customers.

- Geopolitical Shifts and Supply Chain Resilience

Recent years have brought unprecedented volatility in non-ferrous metals markets, mainly due to shifting trade policies, tariffs, and global disruptions. Leading producers and consumers are responding with investments in local capacity and new joint ventures. For example, Rio Tinto is moving ahead with a new multi-million-ton aluminum smelter in southern India, powered entirely by clean energy—a strategic play to hedge against supply risk and environmental pressures. Additionally, governments are introducing schemes to encourage domestic extraction and recycling, partially in response to export restrictions from large suppliers like China. As companies and policymakers double down on resource security, the global landscape of non-ferrous metals becomes more adaptive, resilient, and regionally diversified.

Our comprehensive non-ferrous metals market outlook reflects both short-term tactical and long-term strategic planning. This analysis is essential for stakeholders aiming to navigate the complexities of the non-ferrous metals market and capitalize on emerging opportunities.

Leading Companies Operating in the Global Non-Ferrous Metals Industry:

- Aditya Birla Group

- Alcoa Corporation

- Aluminum Corporation of China Limited

- Anglo American plc

- BHP

- RUSAL (En+ Group MKPAO)

- Glencore Plc

- Norilsk Nickel

- Rio Tinto Group

- Sumitomo Metal Mining Co. Ltd.

- Vale S.A

Non-Ferrous Metals Market Report Segmentation:

By Type:

- Aluminum

- Copper

- Lead

- Tin

- Nickel

- Titanium

- Zinc

- Others

The non-ferrous metals market is segmented by type into aluminum, copper, lead, tin, nickel, titanium, zinc, and others, with aluminum being the largest segment.

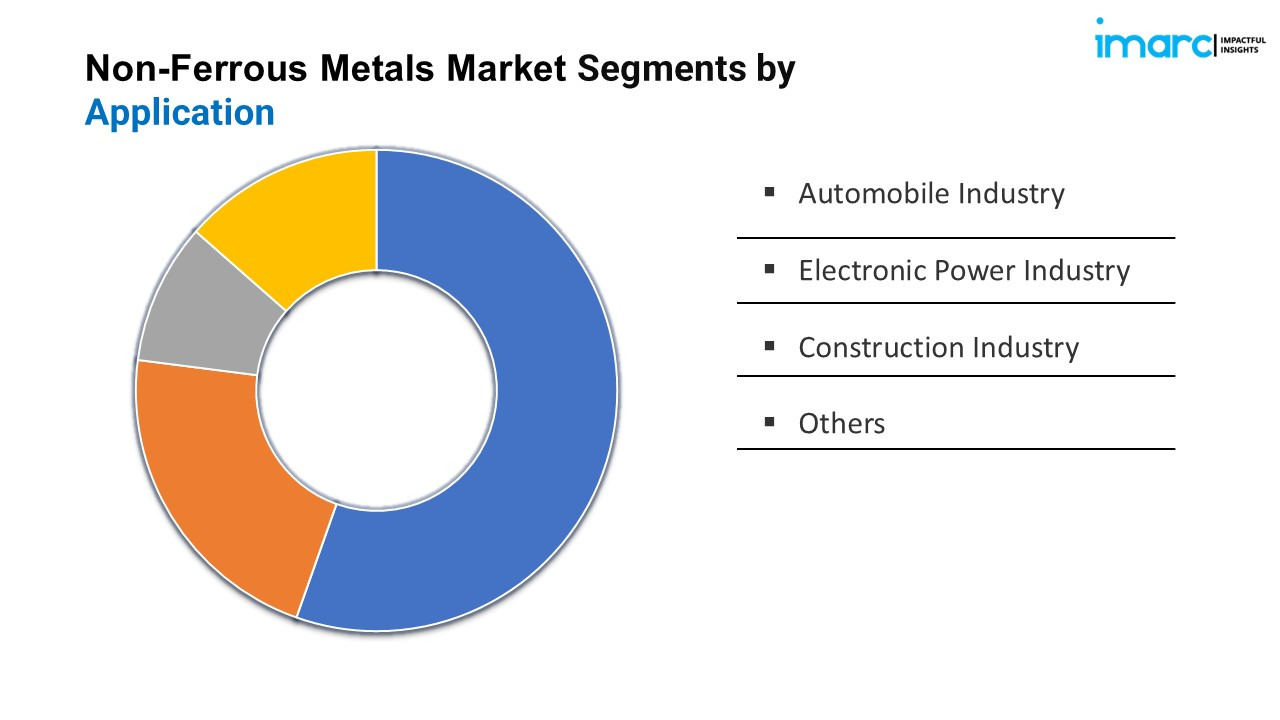

By Application:

- Automobile Industry

- Electronic Power Industry

- Construction Industry

- Others

The market is analyzed by application, including the automobile industry, electronic power industry, construction industry, and others, with the automobile industry holding the largest market share.

By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

The non-ferrous metals market is divided by region into North America (U.S. and Canada), Europe (Germany, France, U.K., Italy, Spain, Russia, and others), Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others), Latin America (Brazil, Mexico, and others), and the Middle East and Africa, with Asia Pacific being the largest regional market due to rapid industrialization and technological advancements.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145