Market Overview:

The tooling industry is experiencing rapid growth, driven by adoption of advanced manufacturing technologies, rising demand for automation and robotics, and expansion of the aerospace and defense sector. According to IMARC Group's latest research publication, "Tooling Market Size, Share, Trends and Forecast by Product Type, Material Type, End Use Industry, and Region, 2025-2033", the global tooling market size was valued at USD 272.7 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 483.8 Billion by 2033, exhibiting a CAGR of 6.6% from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/tooling-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends And Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Tooling Industry

- Adoption of Advanced Manufacturing Technologies

The tooling market is rapidly expanding because of the utilization of advanced manufacturing technologies like additive manufacturing (3D printing) and computer numerical control (CNC) machining, where manufacturers can make very complex features into their tools, and they do so at a much lower cost and much faster. For example, companies like General Electric have employed 3D printing to create very complex tooling components for the aerospace industry, and GE estimated savings in lead-time and material waste. In addition, smart factories that employ IoT-enabled tools and connected robots can be monitored in real-time, and predictive maintenance will increase demand. The transition to advanced technologies increased productivity, offers new pathways for customization, and the factor will continue to impact growth for the tooling market.

- Rising Demand for Automation and Robotics

The growing prevalence of automation and robotics in sectors is a major factor in the growth of the tooling market. Automated systems rely on tools developed for automation, including precision grippers, and cutting tools to accommodate high-speed and accurate production and assembly. For example, manufacturers of vehicles, including Tesla, frequently rely on custom tooling solutions, such as specialized fixtures, to support robotic assembly lines to ensure consistent quality and improved efficiency. As consumer demand increases, there will be a greater need for durable and highly specialized tools in industries, such as electronics, automotive, and logistics that are capitalizing on automation. Notably, many emerging economies are adopting industrial automation at a faster rate, providing new opportunities for tooling manufacturers.

- Expansion of the Aerospace and Defense Sector

The rapid growth of the aerospace and defense industry is also increasing the demand for high-precision tools. More investment in space exploration and defense modernization means that manufacturers are going to need tools that will meet demanding quality and performance standards. Consider Boeing's manufacture of next-generation aircraft utilizing advanced tools for its composites and lightweight alloys. The same can be said for space rockets. Companies such as Space X require specialized tooling to aid in the manufacture of rockets. Innovation paired with reliability will continue to be the motivating force behind cutting-edge and advanced tooling solutions such as high-speed cutting tools, specially designed molds etc. As global aerospace, and with it, tooling, and related, activities continue to expand, it will be continuing, prolonged demand for our high-precision durable tools.

Key Trends in the Tooling Market

- Shift Toward Sustainable Tooling Solutions

Sustainability is changing the tooling marketplace as manufacturers turn to eco-friendly practices and processes. Tool manufacturers are using recyclable materials and/or adopting energy-efficient manufacturing processes to diminish their detrimental effect on the environment. Sandvik Coromant, for example, has recently rolled out tooling solutions made of recycled carbide that uses less scrap while maintaining performance. Furthermore, toolmakers are investing in tools that last longer to minimize replacements, which serves circular economy purposes. There is mounting regulatory pressure and more consumer demand for sustainable goods than ever before. This has allowed tooling companies to innovate in material sciences and manufacturing processes in future to take advantage of other all sustainable alternatives.

- Integration of Digital Twin Technology

Digital twin technology is fundamentally changing the tooling market by allowing manufacturers to create a virtual twin and simulation of tool performance and how the tool is being manufactured. This, in its simplest form, provides manufacturers with the ability to produce optimized designs for tools and helps manufacturers predict maintenance of tools before any actual machining is done. For example, Siemens has developed a case study showing how they leverage digital twins capabilities to simulate CNC machining processes which help reduce errors and downtime during actual machining. By coupling digital twin capabilities with IoT and AI, tooling manufacturers may improve precision and efficiency, further providing customized solutions to their clients. Digital twin technologies are rapidly being adopted in other industries like automotive and aerospace, where precision and reliability are vital. These industries will produce warp-speed innovation in the tooling industry.

- Growth of Customization and Modular Tooling

Customization and modularity in tooling represents a significant trend in manufacturing, as industries seek more flexible tooling solutions to accommodate different kinds of production needs. Modular tooling systems allow interchangeable components so that the manufacturer can configure tools to perform multiple applications as requested by customer specifications. By using interchangeable components, the manufacturer can reduce costs by reusing expensive components and less downtime waiting on components, all while providing service with customized solutions. Kennametal's modular tooling systems are commonly used in the automotive manufacturing sector due to the varying geometries of different part shapes. Customization can also provide leveraging of small-batch production capabilities to small, unique markets in the medical device industry. This trend highlights market interest in responsiveness and convenience, and also allows a manufacturer to respond quickly to changing consumer preferences, technological innovation, and advancements in product development.

Leading Companies Operating in the Global Tooling Industry:

- Agathon AG

- Bharat Forge Limited

- Carlson Tool & Manufacturing Corp.

- Doosan Machine Tools Co. Ltd. (DTR Automotive)

- Godrej & Boyce Manufacturing Co. Ltd.

- Omega Tool Corp

- Samvardhana Motherson Group

- Sandvik AB

- Siemens AG

- Stratasys Direct Inc.

- Unique Tool & Gauge Inc.

- Yamazaki Mazak Corporatio

Tooling Market Report Segmentation:

By Product Type:

- Dies and Molds

- Forging

- Jigs and Fixtures

- Machines Tools

- Gauges

dies and molds dominating the market at 40.8% in 2024, essential for mass production across sectors due to their precision in crafting materials, driven by the demand for complex designs and advancements in automation.

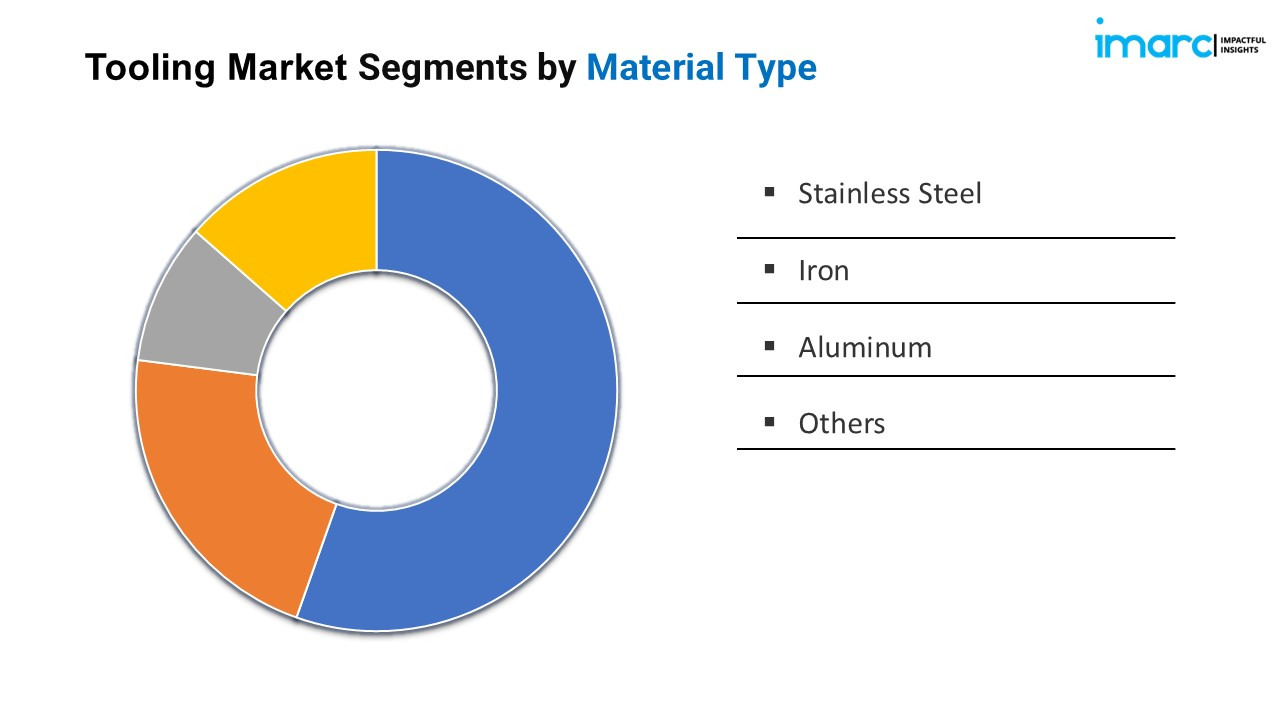

By Material Type:

- Stainless Steel

- Iron

- Aluminum

- Others

Stainless steel holds a significant market share for its strength, durability, and corrosion resistance, making it ideal for high-performance tooling in industries like automotive and aerospace.

By End Use Industry:

- Automotive

- Electronics and Electrical

- Aerospace, Marine and Defense

- Plastics Industry

- Construction and Mining

- Others

Automotive leading the market with 52.5% share in 2024, driven by the need for precision components and innovative tooling for EVs and hybrid models, alongside increasing automation in manufacturing.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Europe holds over 40.00% market share in 2024, supported by a strong manufacturing base, technological advancements, and a focus on sustainability, with initiatives like the UK Tooling Alliance enhancing local manufacturing capabilities.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145